Stock Warrants vs. Stock Options: What’s the Difference?

If you lead a startup that’s attracting new investors and hiring new employees, it’s a good idea to familiarize yourself with the different types of equity and equity derivatives that can find their way into a growing company’s cap table.

Maybe you already know all about stock options and how they work. After all, employee stock options are among the most common types of equity compensation offered at early-stage companies. But another equity type you may be less familiar with is stock warrants — and to fully explain warrants, it helps to compare warrants vs. options. Examining the similarities and differences between warrants and options can help us better understand how each works, and where each fits into a well-managed cap table.

In this guide, we’ll start by reviewing the basics of stock warrants and stock options. We’ll then review some key qualities they share in common before diving deeper into the major differences between the two.

- Stock warrants vs. options: An overview

- Understanding stock warrants and stock options

- What are stock warrants and how do they work?

- What are stock options and how do they work?

- 4 key similarities between warrants and options

- 4 key differences between warrants and options

- Stay on top of your company’s cap table with Pulley

Stock warrants vs. options: An overview

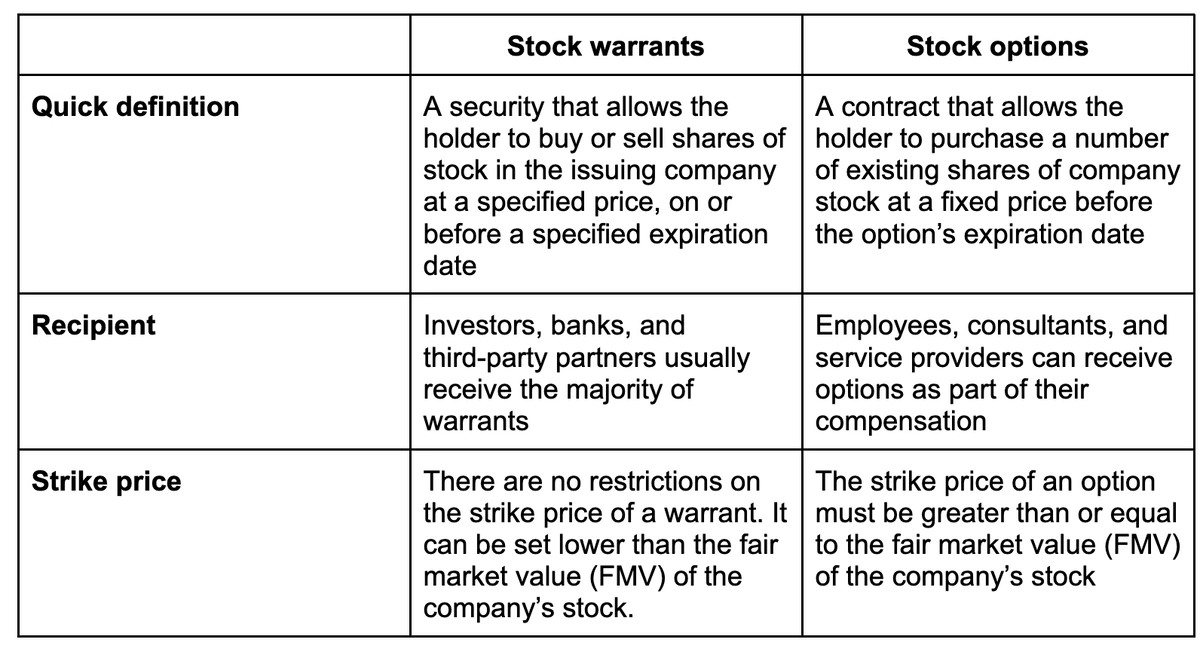

The following table offers a high-level comparison of stock warrants vs. options within the context of a typical startup. There may be exceptions or differences that apply in certain cases or contexts, and we’ll cover some of those exceptions later in this guide. Given the complexities involved in issuing warrants and options, we recommend consulting with an equity and/or legal professional.

Understanding stock warrants and stock options

As you likely gleaned from the table above, stock warrants and stock options actually have a lot in common. Both are types of derivatives that allow, but do not obligate, the holder to buy or sell a company’s stock at a specified price (referred to as the “strike price” or “exercise price”) on or prior to a specific date.

Before we get too ahead of ourselves, let’s take some time to review the basics of warrants and options. The differences will become clearer as we further define each—but just in case, we’ll also spell them out for you below.

What are stock warrants and how do they work?

A stock warrant is a security that allows the warrant holder to buy or sell shares of stock in the issuing company at a specified price on or before a specified expiration date. Note that the warrant holder isn’t obligated to exercise a warrant. They have the right to let the warrant expire if they choose not to use it to buy or sell shares of the underlying stock.

Private company warrants vs. public company warrants

It’s important to know up front that warrants can work differently depending on whether the company is private (like a startup) or public.

For warrants issued by private companies, which are the kind we’re chiefly concerned with at Pulley, there are two crucial differences between warrants and stock options:

- Who they’re issued to. Warrants are typically issued to outside parties such as investors and banks. Stock options, on the other hand, are typically issued to employees, consultants, or other service providers.

- How the exercise price is regulated. The exercise price of warrants is not regulated, so it can be set based on whichever terms the company and these outside parties agree upon. This is different from stock options, whose strike price cannot be below the fair market value of the stock at the time of issuance.

Why do companies issue stock warrants?

Companies issue warrants for a number of reasons. Issuing warrants can help to raise capital in early financing rounds, as they give investors an extra incentive to purchase the company’s stock. Warrants may also be issued as part of a lending deal with a bank, or as part of transactions with third-party partners.

Are there different types of warrants I should know about?

There are a few different types of warrants that work in different ways. Call warrants, for example, give the holder the right to buy shares from the issuing company, while put warrants give the holder the right to sell shares back to the company. Put warrants will almost never appear within the context of a VC-backed startup or private company. It’s theoretically possible, but private companies deal almost exclusively with call warrants.

In the world of warrants, other distinctions besides “call vs. put” can also apply. But in many cases, these distinctions are more relevant for public company warrants. For a deeper dive on the different warrant types and a review of the key terms associated with warrants, check out our comprehensive guide to stock warrants.

What are stock options and how do they work?

A stock option is a contract that allows the holder to purchase a number of shares of stock at a fixed price (a.k.a. the exercise price or strike price). What is it called an “option?” Because the holder has the option to buy or sell a share of stock at the price associated with the option contract—but they aren’t obligated to.

Are there different types of stock options I should know about?

When comparing stock options to warrants, the waters can get muddy if we don’t clarify which type of options we’re talking about:

- Exchange-traded options are a type of financial instrument that investors can buy and sell on a stock exchange. In other words, you don’t need to be an employee at a company to buy or sell these option contracts.

- Employee stock options (ESOs) are a bit different. These are a common type of equity compensation that gives an employee of a company the right, but not the obligation, to purchase shares of company stock at a specified price. ESOs generally can’t be traded on exchanges. There are a couple of different types of ESOs, which you can read about in our guide to startup stock options.

Within the context of private companies, we’re generally talking about employee stock options unless we specify otherwise.

Call options vs. put options

Aside from the above, there are two other general categories of options you should know about. The first are call options, which grant the holder the right to buy the underlying security (e.g. common shares of company stock). The second are put options, which grant the holder the right to sell the underlying security. Employee stock options almost always give the employee the right to buy shares, so these would be classified as call options.

While options trading on exchanges may be interesting to established traders and retail investors, we’ll mainly focus on employee stock options in the remainder of this guide. These are the kind you’ll encounter when granting equity to employees and modeling dilution.

4 key similarities between warrants and options

Warrants and options are a bit like step-siblings. They share some important stuff in common, but you wouldn’t mistake one for the other. Here are some of the key qualities that happen to apply to both.

1. They’re both derivatives

Warrants and options both derive their value from an underlying asset, such as common shares of a company’s stock. Because of this, we call them derivatives. In both cases, the holder gets exposure to the rise or fall in the underlying stock price without actually owning the underlying stock.

2. They both expire at some point

Both warrants and options have an expiration date. If the holder chooses not to exercise their warrant or option on or before this date, it will expire and essentially be worthless. Interestingly, some warrants require the holder to exercise the warrant on the expiration date, if they decide to exercise it at all. These are called European warrants.

3. Their pricing models account for intrinsic value and time value.

Though the specific pricing models for options and warrants vary in some particulars, they both take into account two basic concepts: intrinsic value and time value.

When talking about warrants or options, intrinsic value refers to the difference between the price of the underlying asset and the exercise price. A warrant or an option has a higher intrinsic value if its exercise price is more profitable relative to the price of the underlying asset. For example, a call option would have a lot of intrinsic value if its strike price is $10 and the price of the underlying stock is $100, because the holder could pay $10 for a share that someone without an option contract would have to pay $100 for.

Pricing models for both warrants and options also take time value into account. Time value accounts for the likelihood of the underlying asset trading at a higher value relative to the warrant or option at the expiry date. Generally speaking, the longer the period of time until expiration, the more valuable the warrant or option.

4. Other similar factors can influence their value

Other factors may also influence the value of a warrant or an option, and many of these factors are similar or very closely related. For example, the underlying stock price is a major factor that determines the value of both a warrant and an option. Other factors that can influence the value of both warrants and options include:

- The exercise price

- The time until expiration

- The volatility of the underlying security

- The risk-free interest rate, i.e. the interest rate an investor can expect to earn on an investment that’s free of risk.

Some of these factors can be a bit complex in terms of how they’re calculated and how they influence pricing. The important thing to note here is that they apply to pricing for both warrants and options.

4 key differences between warrants and options

We hope you weren’t getting too comfortable with all the ways in which warrants and options are similar, because there are just as many which they differ. Let’s look at some of the major differences that distinguish these two derivative types.

1. They’re typically issued to and owned by different parties

Companies most often issue stock warrants when they want to raise capital from banks or secure better lending terms from banks. This means that warrants most often end up in the hands of—you guessed it!—investors and banks. Other third-party providers may also receive warrants in certain business deals, but it’s far less common for employees and other types of service providers to own warrants or receive them as compensation.

Employee stock options—the type of stock options we are chiefly concerned with here—are among the most popular forms of startup equity compensation in the U.S. Relative to warrants, they are far more likely to be issued to employees and other service providers (contractors, consultants, advisors, vendors, etc.). This is not a hard-and-fast rule. But within the context of private companies, different categories of people generally own warrants vs. options.

2. A company must create new shares when a warrant is exercised

Stock options don’t require the issuance of new stock upon exercise. This doesn’t mean employee stock options are not dilutive—generally speaking, they are. But exercising options doesn’t involve issuing new stock. And when options are granted to employees, they generally come out of an option pool of shares of stock that’s already been set aside for those employees, so shareholders can think of the option pool as already diluting their holdings.

On the other hand, if a warrant holder decides to exercise their warrant, the company must issue new shares of stock to cover the number of shares in the exercised warrant. This issuance of new stock means that warrants are dilutive. In other words, by creating new shares of stock, the company is effectively diluting the equity value of all the existing shares.

3. Warrants and options may have different strike prices

The strike price for warrants and options issued at or around the same time may differ significantly.

A company can’t simply decide to offer options with any strike price it wants. The strike price for employee stock options is informed partly by the fair market value of the company’s stock—a figure that may be calculated as part of the 409A valuation process. Other compliance requirements may also apply.

Warrants, on the other hand, offer more freedom and flexibility. A company may offer non-compensatory warrants with a strike price that’s far below the fair market value of its stock as a means of enticing investors.

4. Warrants are typically issued with bonds

In many cases, warrants aren’t issued by themselves. Instead, they’re attached to newly issued bonds or shares of preferred stock. Whether or not these warrants can be “detached” from the bonds or stock in question depends on the type of the warrant. If the holder is able to sell the warrant separately, then it’s a detachable warrant (versus a non-detachable warrant). Since detachable warrants offer more flexibility, investors tend to favor them.

Stay on top of your company’s cap table with Pulley

By now, you should have a clearer picture of how warrants and stock options differ. Both of these equity types can coexist in the same cap table, so it’s important to understand how each works. It’s also important to accurately record them in your cap table as they’re issued—and there’s where Pulley can help.

With Startup, Growth, and Custom plans designed to scale alongside your business, Pulley can help you stay on top of your company’s equity picture even as its complexity grows. Schedule a call with us today to learn how we can help.